When it comes to purchasing a home, there is 30-year vs 15-year mortgage loans. Each has its own set of advantages and disadvantages, and understanding these can help you make an informed decision that aligns with your financial goals. In this article, we will explore the structure of these loans, qualification criteria, pros and cons, and the conditions under which each option may be favorable.

How the 30-Year Mortgage Loan is Structured Internally in the United States

A 30-year mortgage is a long-term loan that allows borrowers to repay the principal and interest over a period of 30 years. The structure of this loan typically involves fixed monthly payments that remain constant throughout the loan term. The payments are composed of both principal and interest, with the interest portion being higher in the early years and gradually decreasing as the principal is paid down.

The amortization schedule for a 30-year mortgage is designed so that the borrower pays off the loan over time, with a significant portion of the early payments going toward interest. This means that while the monthly payments are lower compared to shorter-term loans, the total interest paid over the life of the loan can be substantial.

What is the Criteria to Qualify for a 30-Year Mortgage?

To qualify for a 30-year mortgage, lenders typically consider several factors:

- Credit Score: A higher credit score can lead to better interest rates. Most lenders prefer a score of at least 620.

- Debt-to-Income Ratio (DTI): Lenders usually look for a DTI ratio of 43% or lower, which means your monthly debt payments should not exceed 43% of your gross monthly income.

- Down Payment: A down payment of at least 3% is often required, though putting down 20% can help avoid private mortgage insurance (PMI).

- Employment History: Lenders prefer borrowers with stable employment and a consistent income history.

- Assets and Reserves: Having savings or assets can demonstrate financial stability and the ability to cover unexpected expenses.

How the 15-Year Mortgage Loan is Structured Internally in the United States

A 15-year mortgage is a shorter-term loan that allows borrowers to pay off their mortgage in half the time of a 30-year loan. Like the 30-year mortgage, the 15-year mortgage also has fixed monthly payments, but the payments are higher due to the shorter repayment period.

The amortization schedule for a 15-year mortgage is structured so that a larger portion of each payment goes toward the principal from the beginning. This means that borrowers build equity in their homes more quickly and pay significantly less interest over the life of the loan compared to a 30-year mortgage.

What is the Criteria to Qualify for a 15-Year Mortgage?

Qualifying for a 15-year mortgage generally involves similar criteria to that of a 30-year mortgage, but lenders may have stricter requirements due to the higher monthly payments:

- Credit Score: A higher credit score is often required, typically 700 or above, to secure favorable interest rates.

- Debt-to-Income Ratio (DTI): A lower DTI ratio is preferred, often around 36% or lower.

- Down Payment: A down payment of at least 5% is common, with 20% being ideal to avoid PMI.

- Employment History: A stable job history is crucial, as lenders want assurance of consistent income.

- Assets and Reserves: Having additional savings can be beneficial, as it shows financial security.

Pros and Cons of a 30-Year Mortgage

Pros:

- Lower Monthly Payments: The extended term results in lower monthly payments, making it more affordable for many borrowers.

- Flexibility: Lower payments allow for more flexibility in budgeting and spending.

- Tax Benefits: Interest payments on a mortgage may be tax-deductible.

Cons:

- Higher Total Interest: Borrowers pay significantly more interest over the life of the loan.

- Slower Equity Build-Up: It takes longer to build equity in the home compared to a 15-year mortgage.

Pros and Cons of a 15-Year Mortgage

Pros:

- Lower Total Interest: Borrowers pay less interest over the life of the loan, saving money in the long run.

- Faster Equity Build-Up: Homeowners build equity more quickly, which can be beneficial if they need to sell or refinance.

- Potentially Lower Interest Rates: Lenders may offer lower interest rates for shorter-term loans.

Cons:

- Higher Monthly Payments: The monthly payments are significantly higher, which can strain budgets.

- Less Flexibility: Higher payments may limit financial flexibility for other expenses or investments.

Conditions and Circumstances Under which 30-Year Mortgage is Favorable

A 30-year mortgage may be favorable in the following situations:

- First-Time Homebuyers: Those who are new to homeownership may prefer lower monthly payments to ease the transition.

- Budget Constraints: If a borrower has a tight budget, a 30-year mortgage can provide more manageable payments.

- Long-Term Plans: If the borrower plans to stay in the home for a long time, the lower payments can be beneficial.

Conditions and Circumstances Under which 15-Year Mortgage is Favorable

A 15-year mortgage may be more suitable in these scenarios:

- Higher Income: Borrowers with a higher income may find the higher payments manageable and prefer to pay off their mortgage quickly.

- Financial Stability: Those with a stable financial situation may prefer the lower total interest and faster equity build-up.

- Long-Term Investment: If the borrower views their home as a long-term investment, paying off the mortgage sooner can be advantageous.

Most Important Factors, Terms, and Conditions to Evaluate Before Signing a Mortgage Loan Document

Before signing a mortgage loan document, consider the following factors:

- Interest Rate: Understand whether the rate is fixed or adjustable and how it affects your payments.

- Loan Terms: Review the length of the loan and the implications of early repayment.

- Fees and Closing Costs: Be aware of any additional fees associated with the loan.

- Prepayment Penalties: Check if there are penalties for paying off the loan early.

- Insurance Requirements: Understand any insurance requirements, such as PMI or homeowners insurance.

Difference Between a 30-Year vs. 15-Year Mortgage Loan

Suppose you borrow $200,000 to buy a home:

- You can take a 30-year fixed-rate loan with a rate of 4.10%

- You can take a 15-year fixed-rate loan with a rate of 3.43%

The 30-year loan would have a lower monthly payment:

- Your 30-year monthly payment: $966

- Your 15-year monthly payment: $1,432

You’ll pay down the balance sooner with a 15-year loan:

- Remaining loan balance on the 30-year loan after 7 years: $172,513

- Remaining loan balance on the 15-year loan after 7 years: $119,674

You’ll pay less interest with a 15-year loan:

- You’ll pay $147,903 in interest costs over the life of your loan with the 30-year option.

- You’ll pay only $56,122 in total interest costs with a 15-year mortgage.

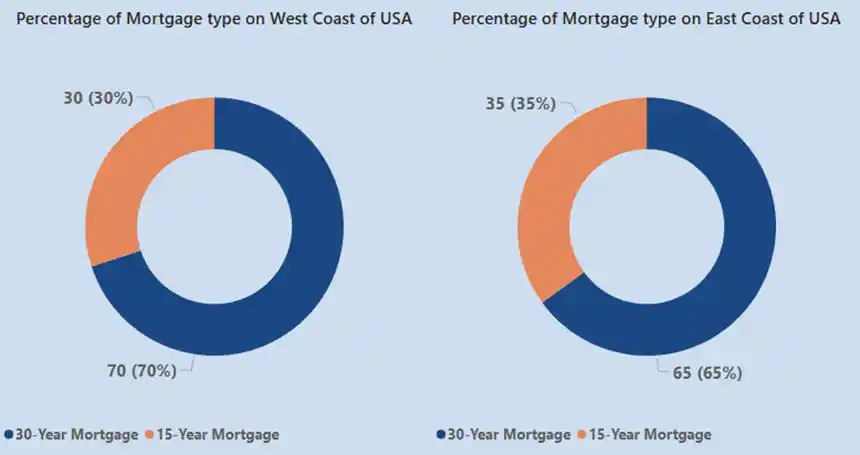

Historical Data Showing Percentages of 30-Year and 15-Year Mortgages on West Coast & East Coast of USA

Summary

Choosing between a 30-year and a 15-year mortgage depends on your financial situation, long-term goals, and personal preferences. A 30-year mortgage offers lower monthly payments and flexibility, while a 15-year mortgage allows for quicker equity build-up and lower total interest. Understanding the structure, qualification criteria, and pros and cons of each option can help you make the best decision for your circumstances.

Frequently Asked Questions

1. Can I refinance my mortgage later?

Yes, refinancing is an option if you find a better interest rate or want to change the loan term.

2. What happens if I miss a mortgage payment?

Missing a payment can lead to late fees and negatively impact your credit score. It’s essential to communicate with your lender if you’re facing financial difficulties.

3. Is it better to pay off my mortgage early?

Paying off your mortgage early can save you money on interest, but consider your overall financial goals and whether you have higher-interest debts to pay off first.

4. How do I choose the right mortgage lender?

Research different lenders, compare interest rates, and read reviews to find a lender that meets your needs.

5. What is PMI, and when do I need it?

Private Mortgage Insurance (PMI) is required if your down payment is less than 20%. It protects the lender in case you default on the loan.